Economic Impact of Unconventional Oil and Gas Production

It has taken millions of years for the ancient organic matter trapped within North America’s geological formations to become the crude oil and natural gas used today.

These naturally formed reservoirs of carbon and hydrogen are easy to extract with minimal damage to the environment. They can be extracted using “conventional” drilling and extracting methods that use natural pressure.

However, many of these oil and gas reservoirs are in decline. Thirty years ago finding oil in North America was not difficult; it was abundant. Nowadays, on the other hand, oil is hard to locate and more costly to extract.

To meet the rising demands, the world has turned to unconventional methods of oil and gas production. All of these strategies impact our world today.

The Growing Demand For Oil and Gas

In 2011, Canada produced more than 2.1 million barrels of oil per day. Even that large amount is not sufficient to meet the country’s demands.

Over the past 20 years, the demand for oil has dramatically risen; making crude oil one of the most sought after, actively traded, commodities in the world.

In fact, it is predicted that the global demand for oil will rise by 14 million barrels per day and will reach a demand for 101 million barrels a day in 2035.

With the decline of conventional resources, to bridge the gap between supply and demand, Canada and the US are exploring and developing unconventional production methods.

Unconventional Oil and Gas Production

Canada is fortunate to have the oil sands of Northern Alberta. And although Alberta’s oil sands are the world’s second-largest source of unconventional oil, this vast unconventional source of oil has many benefits and downfalls.

For one, extracting oil from sand is an expensive process. The sands are located in a remote area of Canada that is difficult to access. Skilled workers must be brought in from other areas of Canada, which also adds to the productions costs.

The oil sands continue to be a source of controversy. Environmental activists such as Greenpeace and Pembina Institute have increasing concerns of ecological harm, as well as the effects of global warming because of the greenhouse gases emitted during the process.

In the United States, the resurgence in oil and gas production is beginning to redraw the global energy map. For one thing, fracking has become an “energy game changer”.

New emerging technologies are unlocking access to light, tight oil and shale gas resources. As a result, this unconventional form of oil and gas production is changing the role of North America in global energy trade, and influencing the prices of gas and electricity in the US. Prices have dropped substantially, giving the industry a competitive edge.

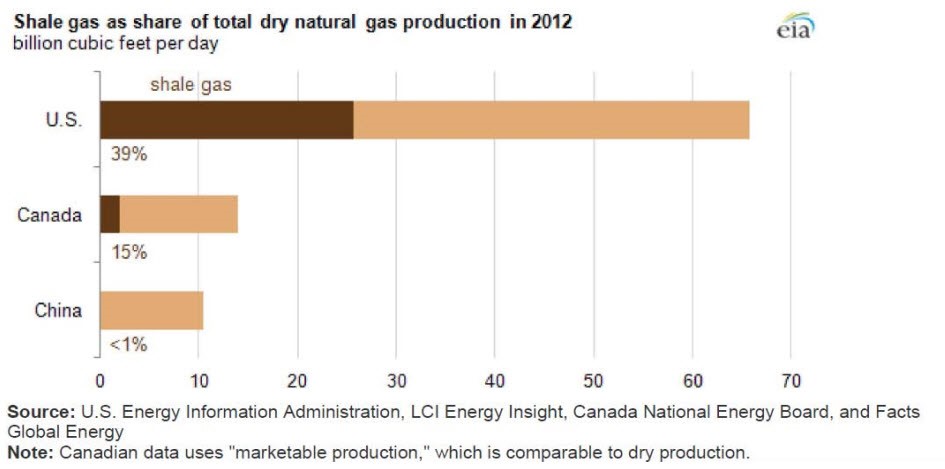

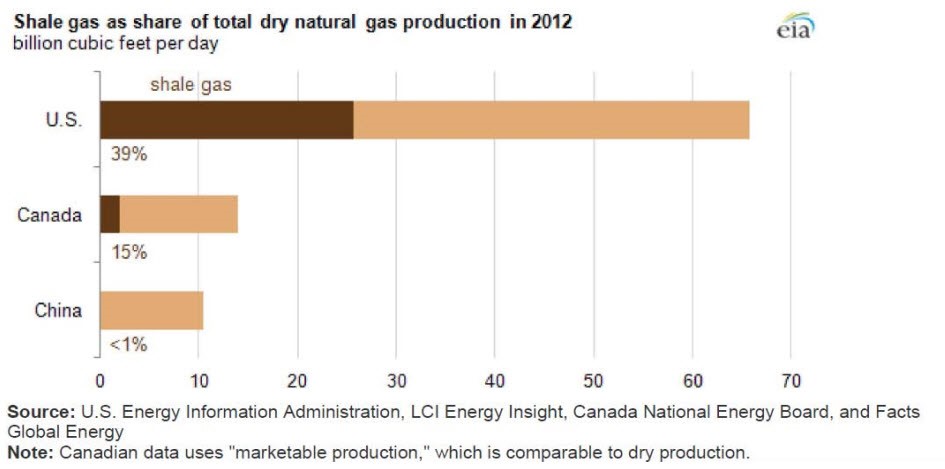

This unprecedented growth of shale production makes the US the largest liquids producer worldwide. In 2012, of all natural gas production, shale production was 39% in the US and 15% in Canada.

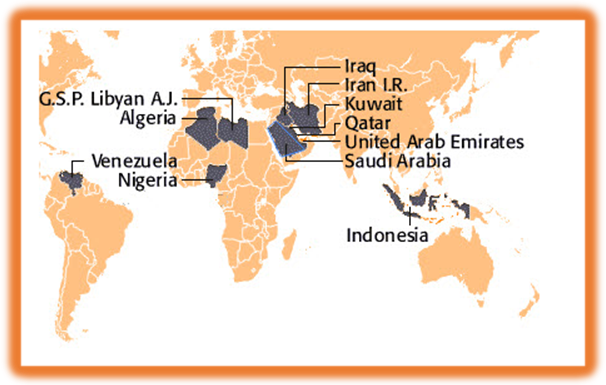

According to a joint US Energy Information Administration (EIA) and Advanced Resources International (ARI) study released in June of 2013 – although a dozen other countries have conducted exploratory test wells – Canada and the US are the only major producers of commercially viable natural gas from shale formations in the world.

Outside of North America, China has registered commercially viable productions of shale gas; however shale contributes to less than 1% of China’s total natural gas production.

The ability to unlock new types of resources (such as light tight oil (LTO) and ultra-deepwater fields) and to improve recovery rates in existing fields shows promising signs. Each year, the amount of oil that remains to be produced is on the rise.

Are Our Oil Troubles Over?

New oil production methods and resources must be discovered. The level of success with LTO needs to be replicated and unconventional resources need to be discovered throughout the country.

For example, the Lorraine Formation in the St. Lawrence Lowlands is predominantly unconventional gas silt and is considered an available resource, but no estimates are available at this time.

Shale gas resources have also been identified in Western Canada, Quebec, the Maritimes and a very small area in Southern Ontario. Extensive exploration is being conducted to quantify the potential of these resources however sustained production is only occurring from the Horn River Basin in northeast British Columbia and a small field of shallow shale gas in the Wildemere region of east central Alberta.

It is crucial to continue the exploration and advancement of technology in this industry, as the economic impact of unconventional oil and gas production is too beneficial to ignore.